Glendale Estate Planning Lawyers

Be Ready For Anything

Estate Planning Attorneys in Glendale, Arizona

Helping with All of Your Estate Planning Needs, Including Wills, Trusts, Advanced Health Care Directives, and More

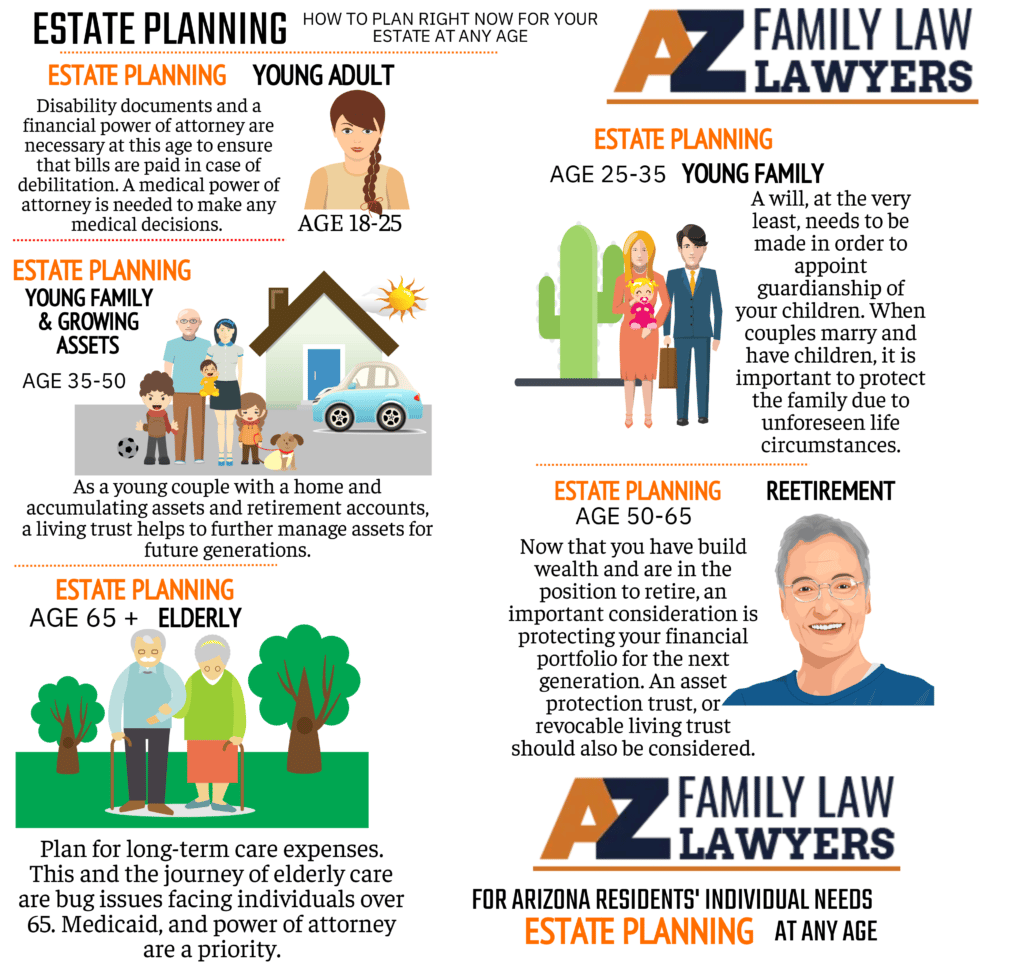

Estate planning isn’t just for the elderly and wealthy. You never know when a serious accident might happen, leaving your loved ones scrambling to act in accordance with what they think your wishes are. Your estate plan can also include documents that let doctors know which treatments you’d like to receive and refuse if you ever have a medical condition that destroys your ability to communicate your preferences. To learn about all of the benefits that planning your estate offers, schedule your free consultation with one of our Glendale estate planning attorneys today.

Plan Your Estate With Wills and Trusts

You don’t need a fancy house on a sprawling property to use estate planning. Your will and other estate planning documents can be used to designate who you would like to receive any of your possessions and real estate property. With an estate plan in place, your family members won’t have to argue about who gets what, because you will have already decided for them. You can choose who will receive your most important belongings, rather than being snatched up by greedy relatives or defaulting to the state.

If you don’t plan your estate before you pass away, your estate will be distributed according to Arizona’s intestacy laws. If you have a surviving spouse or children, grandchildren, etc., they will be the first in line to receive your estate. If you don’t have a surviving spouse or descendants, your estate would next go to your surviving parents, if applicable. If your parents predeceased you, it would next go to their descendants, or your siblings, nieces, nephews, etc. Relatives further from you on the family tree stand little chance to get any of your possessions through intestate succession. Friends and charitable organizations stand no chance at all.

Whether you have a family business, a large estate, or even a relatively small one, our Arizona estate planning attorneys have the knowledge and experience to help you achieve your goals for your estate. We can also help you amend your estate plan if you have experienced family changes like the birth of a child or a divorce. If necessary, we can coordinate with your accountants and wealth management team to make sure that your estate is planned as strategically as possible.

Attorneys for Glendale Estate Planning

A well-crafted estate plan will help your beneficiaries enjoy every advantage and avoid pitfalls in the probate process. For example, if you have designated an expedient and responsible executor in your will, they will have already gotten to work on your estate before a court could assign an executor to your estate if you passed away intestate. A properly executed will should be validated by the court, while a will that doesn’t comply with Arizona’s statutory requirements could be susceptible to disputes. If you are ever left in a coma or similar medical condition after an accident, your loved ones could destroy their relationships and spend thousands of dollars litigating which choices should be made.

Contact Our Estate Planning Attorneys and staff today for assistance with planning your estate in Arizona.

My Arizona Lawyers estate planning team help people throughout Arizona by safeguarding their future with a reliable Arizona estate plan. Our experienced estate lawyers have great attention to detail and personally attend to our clients who are seeking: Wills, Trusts, Probate, and Estate Planning. Call our office for a free consultation (480) 833-8000. You can also fill out our on-line consultation request form, and we will assist you by scheduling a free consultation.

Book a Free Estate Planning Consultation Today

Protect your future, we can help!

Arizona Estate Planning FAQs

What happens if I pass away without an estate plan?

Why else do I need to plan my estate?

What is a will?

What is an executor?

What are the legal requirements for a valid will in Arizona?

Can I change or cancel my will?

What is probate?

What is a power of attorney?

What is a power of What is a health care power of attorney??

What is a living will?

How do I revoke a power of attorney?

What is a trust?

Do I need an attorney to draft my will and other estate planning documents?

What is Estate Planning?

Estate planning is the process of creating valid legal documents to determine how certain issues will be resolved after your death, including the distribution of your assets, how you would like to be buried, and more. You can also create documents that will give a loved one the power to make medical decisions on your behalf if you ever become physically or mentally incapacitated. Some of the documents may choose to use include:

Who Needs An Estate Plan?

In Arizona, anyone who is over the age of 18 years old and of sound mind can create an estate plan. Thus, you don’t necessarily have to be rich or have many assets to warrant estate planning.

Do you own a home? A vehicle? A bank account? If you answered yes to any of these questions, or own any other type of property, you have an estate. That means that you should at least consider creating an estate plan. This is also the only way that you can guarantee that your estate benefits anyone you aren’t legally related to, as well as any charitable organizations that you support.

Another common misconception about estate planning in Glendale, Arizona is that you don’t need to worry about it until you are older. Unfortunately, life is unpredictable, and you never know how young or old you’re going to be when you go. So, even if you feel young and healthy, your loved ones will be grateful if the worst occurs, and you have an estate plan in place.

Do you have children? Anyone who depends on you? Someone who deserves to have their financial burden eased? Then you should create your estate plan.

Using Trusts to Achieve Your Estate Planning Goals

Depending on the goals you wish to accomplish through your estate, it may actually be more efficient to distribute some of your assets through trusts rather than through your last will and testament. When you contribute assets to a trust, a trustee will hold the asset, maintaining it and keeping it profitable.

There are several reasons you may find it advantageous to distribute your estate through one or more trusts:

-

Trusts transfer to your beneficiaries either when you pass away or when a certain condition is met, without going through the probate process. This usually means that a beneficiary will receive the contents of a trust much sooner than what they would receive from a will.

-

Because trusts get to bypass the probate process, this also helps maintain the privacy of both the grantor and the beneficiaries.

-

Trusts can be used to serve specific purposes, such as providing for your child’s education, or to financially support a loved one with an illness or disability.

-

When planned properly, using trusts can help you avoid some tax liability on your estate. For example, if your estate would be subject to federal estate tax liability, you could use a trust to bring your estate back under that amount.

-

While many trusts go into effect after you pass away, you can also transfer assets through a trust during your lifetime. This is known as a living trust, which you can create to either be revocable or irrevocable.

Leave Important Decisions in the Hands of Someone You Trust with a Power of Attorney

Whether you’re in a medical state that renders you incapable of making decisions, will be out of the country for an extended period of time, or simply need someone else’s assistance in completing important daily transactions, you should consider using a power of attorney. This document enables someone you trust to act as your agent, or your attorney-in-fact. You can choose which specific conditions you would like to trigger the power of attorney, and a power of attorney can be revoked unless you are legally incapacitated.

It can be uncomfortable to think about giving someone the authority to make significant decisions about your life. But wouldn’t you rather select someone for this responsibility, rather than leave these decisions up to your doctors or whoever wins in court?

You can also limit the scope of authority that your power of attorney has. A general power of attorney is the broadest, giving the agent the authority to make financial decisions, business decisions, and more. Also, a limited or special power of attorney only gives the agent the authority to complete specific transactions. Whereas, a health care power of attorney, also known as a health care proxy, gives the agent the authority to make decisions regarding your medical treatments should you become incapacitated. If you would like to make some of these decisions in advance yourself, you should use an advanced health care directive, or a living will. Hopefully, you will never find yourself in a situation where these documents become necessary, but it will save yourself and your family pain and strife if you have already made your wishes known. All these are something that our experienced Glendale Estate Planning Lawyers can assist.

Experienced, Trusted Legal Service

Rest Easy Knowing Your Estate is Planned by an Experienced Arizona Attorney

Clearly, there is more to planning your estate than simply writing out your last will and testament. There are specific requirements for each type of document, and these vary by state. Failure to meet these requirements could mean your will and other estate planning documents will be invalidated, leaving your estate as a free for all after your passing. Fighting over assets after your death could destroy the relationships within your family. Make your wishes clear with a clearly drafted, valid Arizona will.

Let Our Glendale Estate Planning Attorneys Properly Address Your Estate

If you want your estate planning documents to be validated in court, your estate to pass through probate as quickly as possible, and want to reduce the tax burden on your loved ones after your death, an experienced Arizona estate planning attorney can help you achieve these goals. Our legal team has the skill set to help you protect business interests, as well as your spouse, children, and other family members. You can be assured that we will thoroughly review each aspect of your estate plan to reduce the risk of potential probate disputes, which in turn will reduce how much your family needs to spend during the probate process.

Many people are intimidated by even the thought of establishing a trust, assuming that they simply don’t have the net worth to qualify. Our estate lawyers can walk you through every aspect of trusts so that you can be confident in your decision to transfer assets this way. Reduce tax liability and probate fees, and make sure your bequests are used in a way that you approve of, all with the guidance of your Arizona estate planning attorney.

Even if you already have an estate plan, your circumstances may have changed so that it is no longer as strategic as it possibly could be. Whether you need a codicil or an entire new estate plan, our attorneys can help you decide what is best for your situation. Our Glendale Estate Planning Lawyers offer free initial consultations, as well as prices and payment plans that will fit your budget.

You don’t need to spend your entire estate just to plan it- call to discuss your options with one of our Glendale Estate Planning Lawyers today to see just how affordable it can be. Schedule your consultation by using our online form or calling (623) 640-4945 today.

Contact The Family Law Attorney